- Tap the ⓘ buttons to learn more — tap again to close

- Your responses build in the "Your Story So Far" sidebar

- Share your input at the end

ⓘ About This Process

This story is part of the Archuleta County & Town of Pagosa Springs Housing Action Plan process. We're working to understand our housing challenges and develop solutions together.

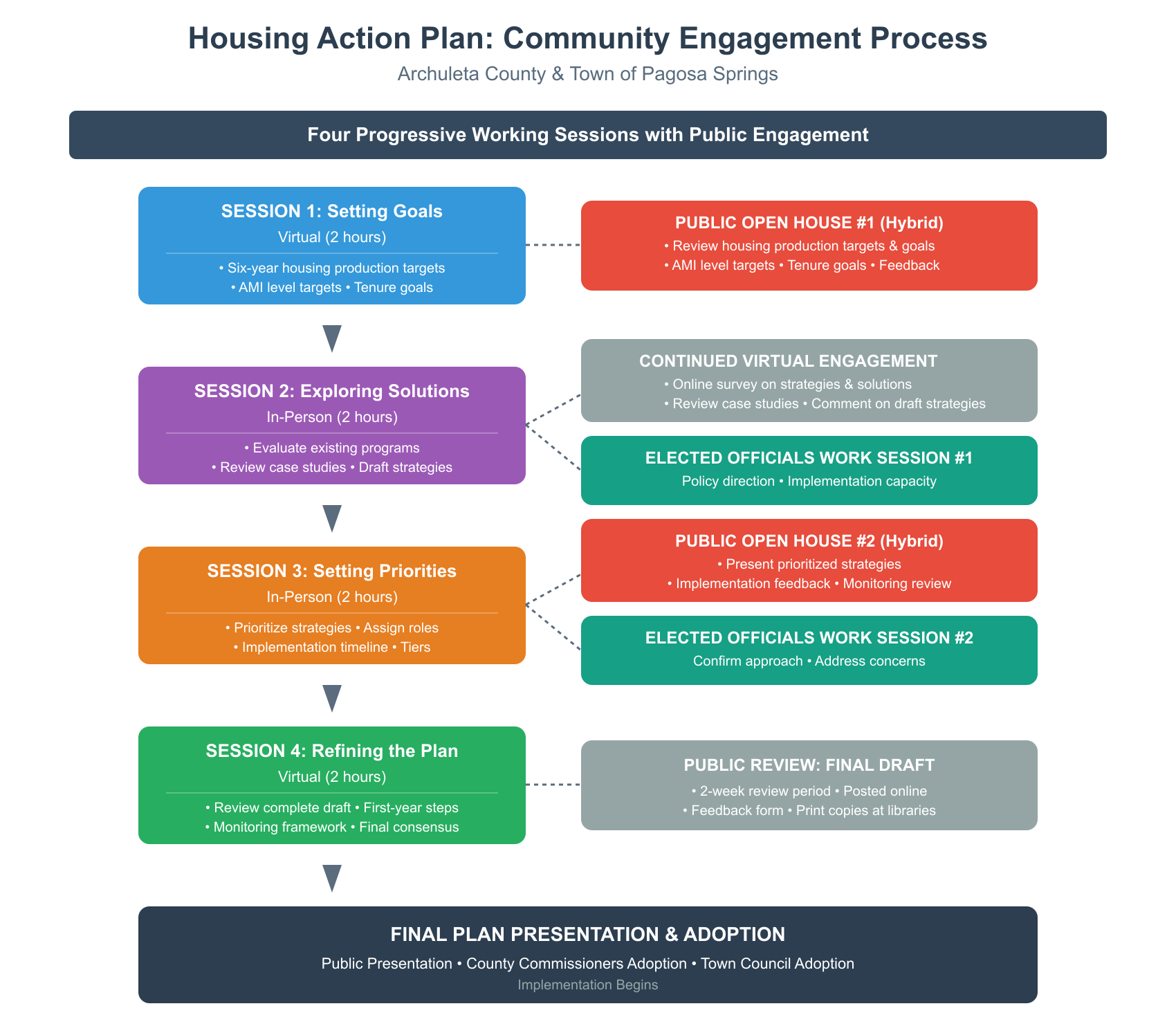

Our Community Engagement Process

The Housing Action Plan is being developed through a series of working sessions with community stakeholders, paired with opportunities for broader public input. This diagram shows how the pieces fit together.

What's a Housing Needs Assessment?

A Housing Needs Assessment (HNA) identifies the type and amount of housing needed to ensure current and future residents and employees at all income levels have access to quality housing they can afford.

The HNA evaluates demographic trends, economic characteristics, housing inventory, market conditions, development opportunities and constraints, and existing programs—combined with input from stakeholders and residents—to identify where the market is meeting needs and where it falls short.

It's an informational tool, not a mandate. An HNA doesn't tell a community to build a certain number of units—it helps communities develop housing action plans tailored to their unique constraints, resources, and capacity.

The Archuleta County & Pagosa Springs HNA was completed in April 2025. Here's how communities use this information:

Source: DOLA Housing Needs Assessment Guidelines

What's a Housing Action Plan?

A Housing Action Plan (HAP) turns the Needs Assessment into action. While the HNA tells us what housing is needed, the HAP determines how our community will respond.

The HAP starts with a vision for housing in our community, then builds out goals (broad outcomes we want to achieve), objectives (measurable targets), strategies (approaches to reach those targets), and actions (specific steps to implement).

Housing opportunity isn't just about building new units. The HAP addresses multiple pathways:

- New construction — creating housing that doesn't exist today

- Preservation — protecting existing affordable units from being lost

- Conversion — repurposing buildings (like motels or commercial space) into housing

- Assistance programs — helping households afford existing housing through down payment assistance, rental subsidies, or employer programs

Actions can include policy changes, funding allocations, intergovernmental agreements, partnerships with employers and nonprofits, land use updates, and more—all tailored to our community's unique constraints, resources, and capacity.

The HAP also includes an implementation plan: timelines for each action, who's responsible, and how we'll track progress. It's a living document—designed to adapt over time as conditions change and we learn what's working and what isn't.

"Archuleta County and the Town of Pagosa Springs will be a community where people at all income levels can find a place to call home—where workers can afford to live near their jobs, families can put down roots, and seniors can age in place."

1 Meet the Community

These aren't real people, but they represent real situations in our community. As you read, consider: Which household's story resonates with you—or reminds you of someone in our community?

Understanding AMI & Cost Burden

Area Median Income (AMI) is the midpoint of household incomes in an area—half of households earn more, half earn less. The U.S. Department of Housing and Urban Development (HUD) calculates AMI annually for every county, adjusting for household size. AMI varies by county based on local wages and is used to determine eligibility for housing funding programs and to set affordable rent levels. For Archuleta County in 2025, 100% AMI for a 2-person household is $81,600/year.

Definitions:

- Affordable housing: Housing where the occupant pays no more than 30% of gross income for housing costs (including utilities)

- Subsidized housing: Housing that receives public funding (tax credits, grants, vouchers) to reduce costs for income-qualified households

- Cost-burdened: A household spending more than 30% of income on housing

- Severely cost-burdened: A household spending more than 50% of income on housing

2025 Archuleta County AMI by Household Size

Average household size in Archuleta County: 2.3 persons

| Category | AMI | 1-person | 2-person | 3-person | 4-person |

|---|---|---|---|---|---|

| Moderate Income | 120% | $85,680 | $97,920 | $110,160 | $122,400 |

| Area Median | 100% | $71,400 | $81,600 | $91,800 | $102,000 |

| Low Income | 80% | $57,120 | $65,280 | $73,440 | $81,600 |

| Very Low Income | 50% | $35,700 | $40,800 | $45,900 | $51,000 |

| Extremely Low Income | 30% | $21,420 | $24,480 | $27,540 | $30,600 |

Source: 2025 CHFA Income Limits

Anna is 34 and moved here in her late 20s. She works as a Certified Nursing Assistant (CNA) at Pagosa Springs Medical Center during the week and picks up server shifts on weekends at a downtown restaurant. Even with two jobs, she rents a one-bedroom apartment and has little left over. She's looked at buying, but the math doesn't work. She's considered moving to Durango, where some coworkers commute from, but doesn't want to spend two hours a day in a car—and give up her second job.

Mike and Jenny are in their late 30s with two kids in elementary school. Jenny is a deputy sheriff; Mike teaches at the middle school. They've rented the same three-bedroom house for six years. The landlord just told them he's selling—and the new owner may not keep it as a rental. They've started looking to buy, but even at 100% AMI, they can't afford the median home.

The 30% affordability rule assumes housing is the only major expense—but with two kids, childcare, healthcare, and transportation costs mean they can't actually afford $2,550/month and still make ends meet.

Linda, 67, worked for the Forest Service for 30 years. Tom, 69, worked various jobs in the county. They live on combined pensions and Social Security. They own a 3-bedroom home worth $450,000, but it's more house than they need now. They'd like to downsize to something smaller—but there's nothing on the market under $350,000.

If they could downsize, they'd free up a family home for the market. But they can't find their next place.

Pat and Chris aren't looking for housing themselves—they own their home. But they can't find workers for their restaurant. They maintain a small year-round crew, but when summer tourism hits and they need to staff up, there's no one to hire. Last summer, they closed two days a week because they couldn't staff the kitchen. When they do find applicants, many back out once they see rental prices—or can't find a place at all during peak season.

"We've turned away business. We've shortened hours. It's not a labor problem—it's a housing problem."

Sam, 45, worked construction for years until an injury sidelined him. Medical bills piled up, then he lost his apartment when he couldn't make rent. He's been couch-surfing and sleeping in his car. He picks up day labor when he can, but without a stable address, holding a steady job is nearly impossible.

Sam represents the 21 people counted as unsheltered in Archuleta County's 2024 Point-in-Time count—10 of whom are chronically homeless.

Which household's story resonates with you—or reminds you of someone in our community?

2 The Math Doesn't Work

The standard measure of affordability is spending no more than 30% of income on housing. Let's see how our households measure up against what the market actually costs.

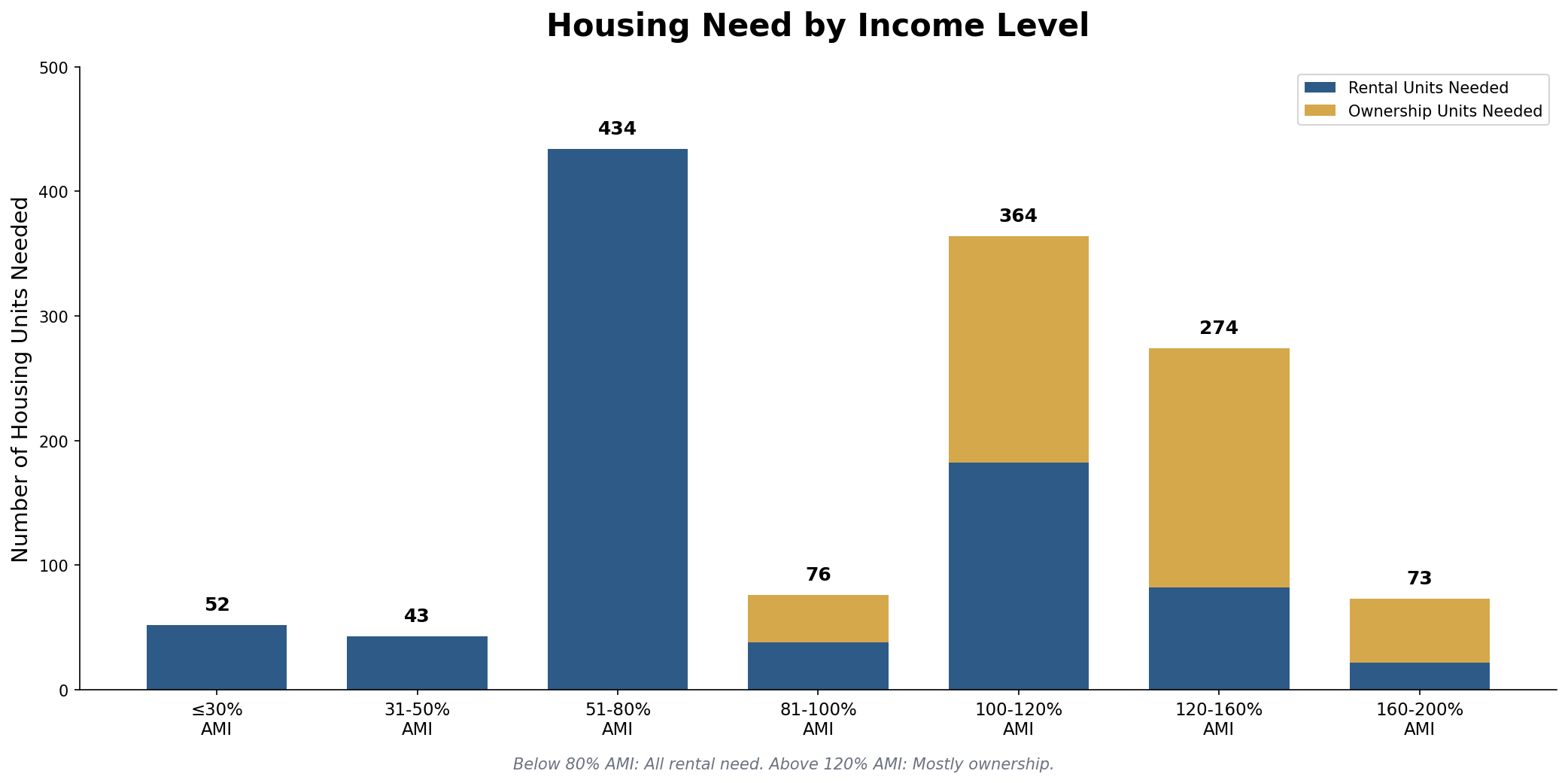

Projected Housing Need by 2035

The 1,316 units needed by 2035 comes from two components: catch-up need (362 units to address current shortages from unfilled jobs, inadequate rental vacancy, and overcrowding) and keep-up need (954 units to house workers filling new jobs and replacing retirees). The analysis uses State Demography Office job projections, local wage data, and employment ratios to determine need by income level. These are projections, not mandates—the community decides how to respond. Market-rate development will meet some of this need; public resources target the gaps.

Rental vs. ownership: The tenure split follows HNA assumptions: households below 80% AMI are assumed to be primarily renters, households between 80-120% AMI are split 50/50, and households above 120% AMI are distributed 70% owners and 30% renters.

Source: 2025 Housing Needs Assessment

Market Trends

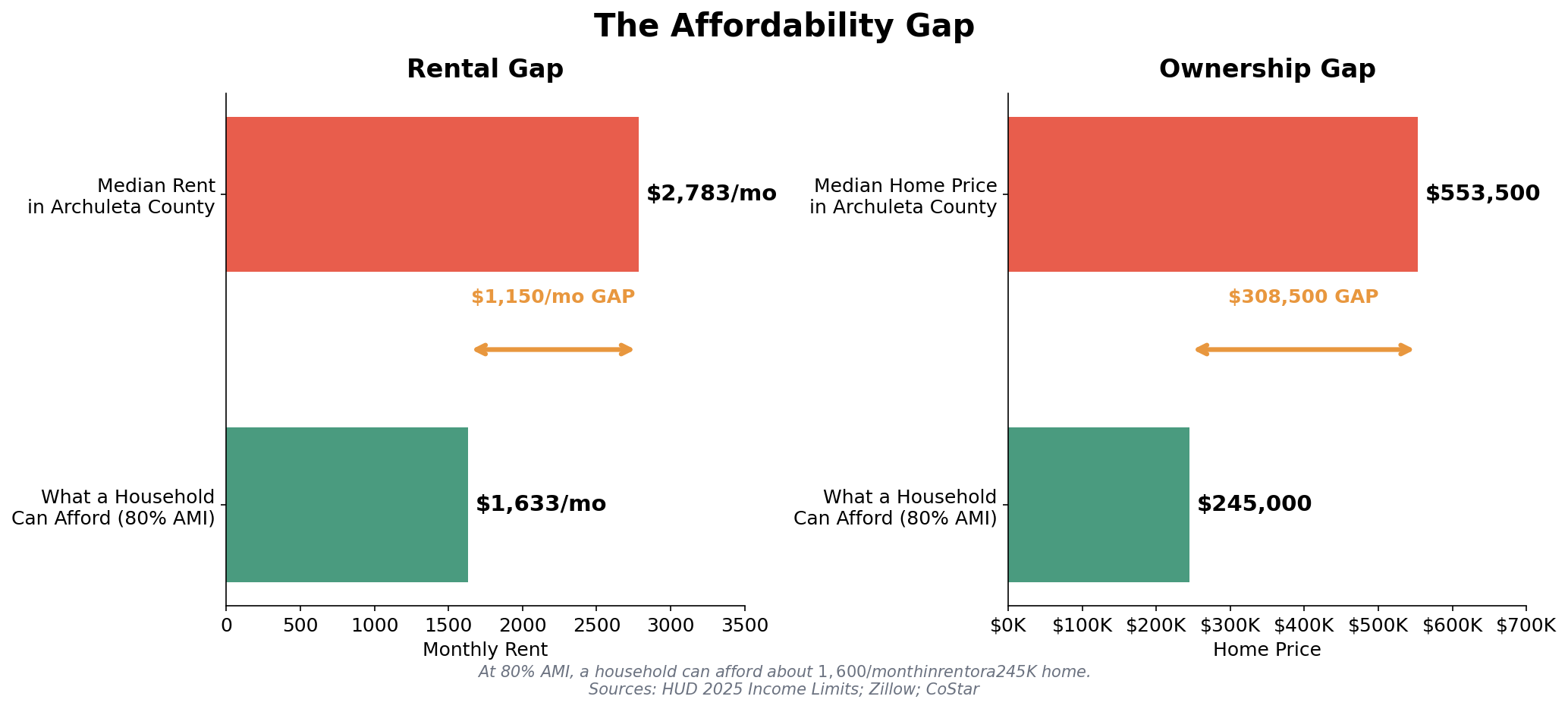

The chart below compares what households can afford to pay with what housing actually costs. At 80% AMI, a household can afford about $1,633/month in rent or a $245,000 home—but the median rent is $2,783 and the median home price is $553,500. Home prices have increased 56% since 2020, and rent is up 57% since 2012. Entry-level homes under $400,000 have nearly disappeared from the market, and 44-48% of households are now cost-burdened.

Source: 2025 Housing Needs Assessment

| Household | Income / AMI | Max Affordable | Median Market | Gap |

|---|---|---|---|---|

| Anna | $52,000/yr (70% AMI) | $1,300/mo | $2,783/mo | -$1,483/mo |

| Mike & Jenny | $102,000/yr (100% AMI) | $385,000 home | $553,500 home | -$168,000 |

| Linda & Tom | $65,000/yr (80% AMI) | $245,000 home | $350,000+ smallest | -$105,000+ |

| Pat's workers | $30,000-35,000/yr (40-50% AMI) | $750-875/mo | $2,783/mo | -$1,900+/mo |

| Sam | Variable/unstable | Transitional housing | None in county | Very limited |

How does this affordability gap show up in our community?

3 It Affects All of Us

Pat & Chris (the restaurant owners) can't find workers, and their story isn't unique. Housing affects more than just the people looking for a place to live—it affects our whole community.

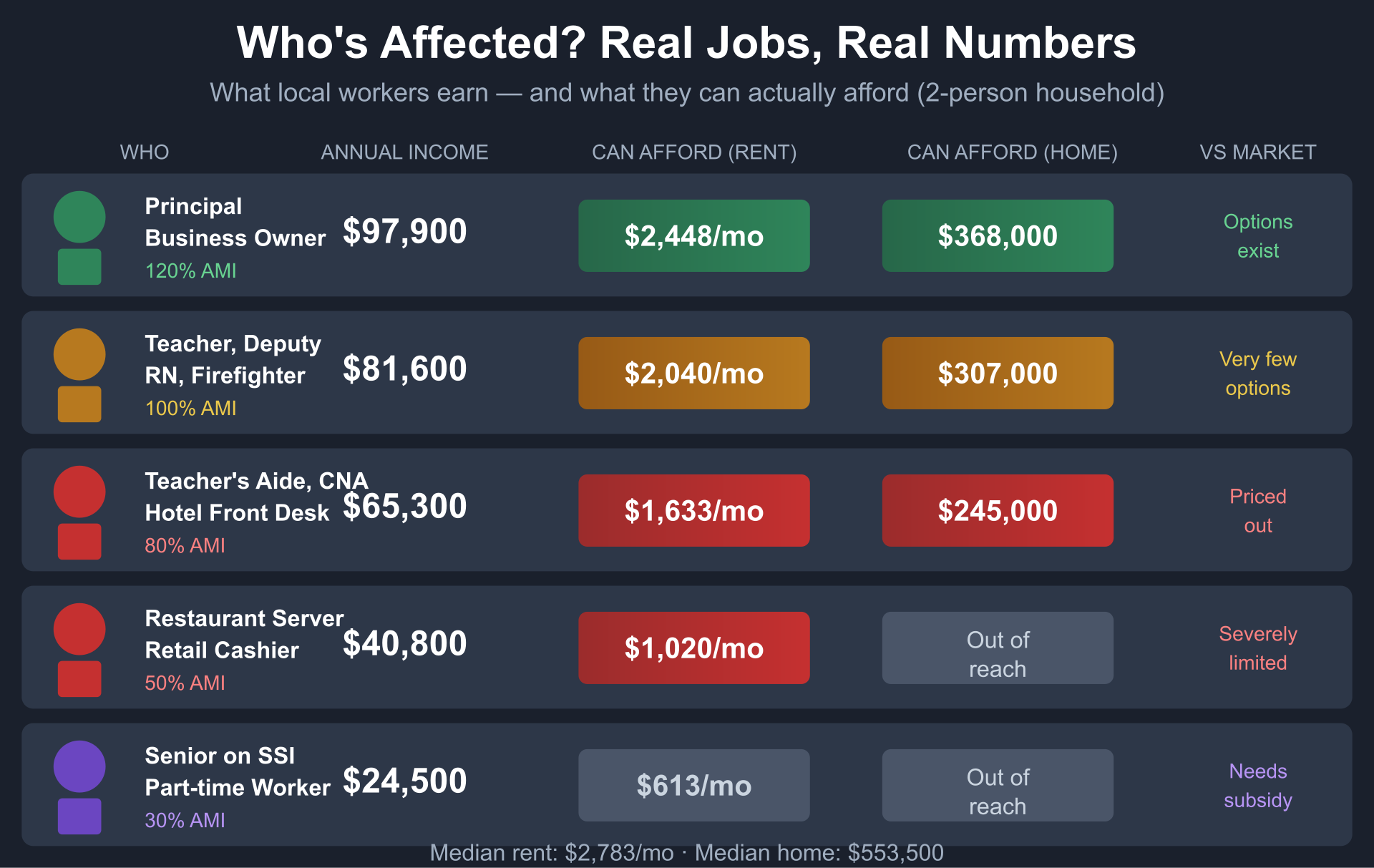

Who's Affected? Real Jobs, Real Numbers

Industries most affected: The workers who keep our community running—restaurant servers, hotel staff, retail employees, healthcare aides, and seasonal workers—are priced out of the market. These jobs typically pay 50-80% of Area Median Income, but housing costs require 100%+ AMI to afford.

Source: 2025 Housing Needs Assessment, Employer Survey

How It Shows Up in Our Community

- As employers: Can't find workers to fill essential positions

- As patrons: Favorite restaurants close early, healthcare has longer waits

- As neighbors: Longtime residents forced to move away

- As taxpayers: Emergency services understaffed, schools struggle to hire

- As community members: Less diverse, less vibrant community

When workers can't live here, businesses can't operate here—and our community loses what makes it special.

How does housing affect you or your community? (check all that apply)

4 We're Not Starting From Scratch

Our community has already taken steps to address housing—and the Housing Action Plan builds on this foundation. Housing is already a priority in both Town and County strategic plans. The question isn't whether to act—it's how. Here's what exists and how it connects to our five households.

| Property | Units | Serving | Status |

|---|---|---|---|

| Rose Mountain Townhomes | 34 | 30-60% AMI | New 2024 |

| Hickory Ridge Apartments | 40 | ≤60% AMI | Short waitlist |

| Archuleta Housing for Elderly | 12 | Seniors 0-30% AMI | — |

| Casa de los Arcos | 16 | Seniors 0-30% AMI | — |

| Socorro Senior Living | 19 | Seniors 0-30% AMI | — |

| Archuleta Housing, Inc. | 52 | Family | — |

| Total | 173 units | ||

About 1,100 housing units are in various stages of planning:

| Project | Units | Affordability | Timeline |

|---|---|---|---|

| Pagosa Views | 650 | 10% deed-restricted | 2026-2040 |

| Timberline Apartments | 50 | LIHTC (30-80% AMI) | 2025-2026 |

| The Enclave | 70 | 60-90% AMI | 2027 |

| Pagosa Peaks | 96 | 10% deed-restricted | 2027 |

| Chris Mountain Phase 2 | 50 | Workforce housing | 2024-2031 |

Good news: If these projects move forward, they could meet much of projected need.

The catch: Most serve moderate- to higher-income households. Fewer address the 30-60% AMI gap.

Housing Choice Vouchers (Section 8)

Federal rental assistance where tenants pay approximately 30% of their income toward rent, and the voucher covers the rest. Vouchers are "portable"—tenants can use them with any landlord who accepts them, giving families flexibility to find housing that meets their needs.

Down Payment Assistance (DPA)

Loans or grants to help first-time buyers cover down payment and closing costs. Often structured as forgivable second mortgages—meaning if you stay in the home for a certain period, you don't have to repay it. Programs like HomesFund offer $15,000-$50,000 to qualifying buyers.

Deed-Restricted Housing

Homes with legal restrictions requiring sale or rent to income-qualified households at below-market prices. The restrictions "run with the land"—meaning they stay with the property even when it changes hands. Restrictions typically last 15-99 years, keeping housing affordable for generations.

LIHTC (Low-Income Housing Tax Credit)

Federal tax credits that incentivize private developers to build affordable rental housing. Developers receive tax credits in exchange for keeping rents affordable for households earning 30-60% AMI. Properties must maintain affordability for 15-30 years. This is the primary way affordable rental housing gets built in the U.S.

🏥 For Anna (Two Jobs, ~70% AMI)

- Hickory Ridge Apartments — 40 units for ≤60% AMI

- Rose Mountain Townhomes — 34 new units at 30-60% AMI (opened 2024)

The gap: At 70% AMI, Anna earns too much for most subsidized programs (which cap at 60% AMI) but far too little for market rent. She's in the "donut hole"—working two jobs with no assistance options.

👪 For Mike & Jenny (Working Family, ~100% AMI)

- HomesFund Down Payment Assistance — Second mortgages of $15,000-$50,000

- Pagosa Springs CDC Workforce Housing — Chris Mountain homes ~$350,000

- Habitat for Humanity — Affordable homeownership (1-3 homes/year)

The gap: Even at 100% AMI, they can't afford the median home. Down payment assistance helps but can't bridge a $168,000 gap.

🏠 For Linda & Tom (Retirees, ~80% AMI)

- Casa de los Arcos — 16 senior units at 0-30% AMI

- Socorro Senior Living — 19 senior units at 0-30% AMI

- Archuleta Seniors, Inc. — Aging-in-place support services

The gap: Very limited smaller housing stock. They earn too much for subsidized senior housing, but can't find anything smaller to buy.

🍳 For Pat & Chris (Employers)

- Timberline Apartments — 50 units at 30-80% AMI (coming soon)

- Pipeline projects — Pagosa Views, The Enclave with deed-restricted units

- Workforce housing developments — Chris Mountain and other projects targeting working families

Source: 2025 HNA Employer Survey

The opportunity: Employers are willing partners—but need coordinated programs and available housing stock to make assistance effective.

🏕 For Sam (Experiencing Housing Instability)

- Housing Choice Vouchers — Rental assistance (~30 vouchers, program at capacity)

- Rise Above Violence — Crisis housing for domestic violence survivors only

- Housing Solutions SW — Rapid re-housing (~5 households/year)

- No emergency shelter — Nearest is Durango (60 miles)

The gap: No emergency shelter in county. No permanent supportive housing for chronically homeless individuals. Very limited transitional housing options.

Archuleta County has no emergency shelter. The nearest is in Durango, 60 miles away. In 2024, 21 people were counted as unsheltered, including 10 who are chronically homeless.

Limited services exist:

- Rise Above Violence provides crisis housing for domestic violence survivors

- Housing Solutions SW offers rapid re-housing (~5 households/year)

- No permanent supportive housing exists for chronically homeless individuals

Which of these programs or resources did you already know about?

5 Your Turn

You've followed five example households through the data. You've seen the affordability gap, the community impact, and what's already happening. Now we want to hear from you.

What Brings You to This Conversation?

What Matters Most for Our Community's Future?

How urgent is each of these needs for our community?

Seven Draft Objectives — Rate Their Priority

How important is each objective for our community?

What's Being Missed?

What do you wish decision-makers understood better about housing in our community?

If You Could Focus on One Thing...

What single action or priority would make the biggest difference?

Anything Else?

Is there anything else you'd like to share?

Your Story So Far

Households that resonate

Affordability gap impacts

How housing affects you

Programs you knew about

What brings you here

Objective priorities

Share Your Story

Your input helps shape the Housing Action Plan. Share your reflections so we can include your voice.

Privacy: Your responses go only to the project team and will be summarized anonymously. We won't share your email or identify you by name without permission.

6 What Happens Next

Data on who needs what, how much, and where

Working group shaping goals and strategies

Community input on vision and priorities

Developing specific actions and roles

Review draft strategies, provide feedback

Town Council and County Commissioners

- Visit the boards and share your input tonight

- Share this story with family: scan the QR at the welcome table

- Sign up for updates at the welcome table

- Watch for Open House #2 this spring